A Qualified Intermediary, also known as a QI, is a neutral third party that facilitates the 1031 exchange process. They are responsible for holding the funds from the sale of the relinquished property and managing the necessary paperwork to ensure the transaction is completed according to the IRS guidelines.

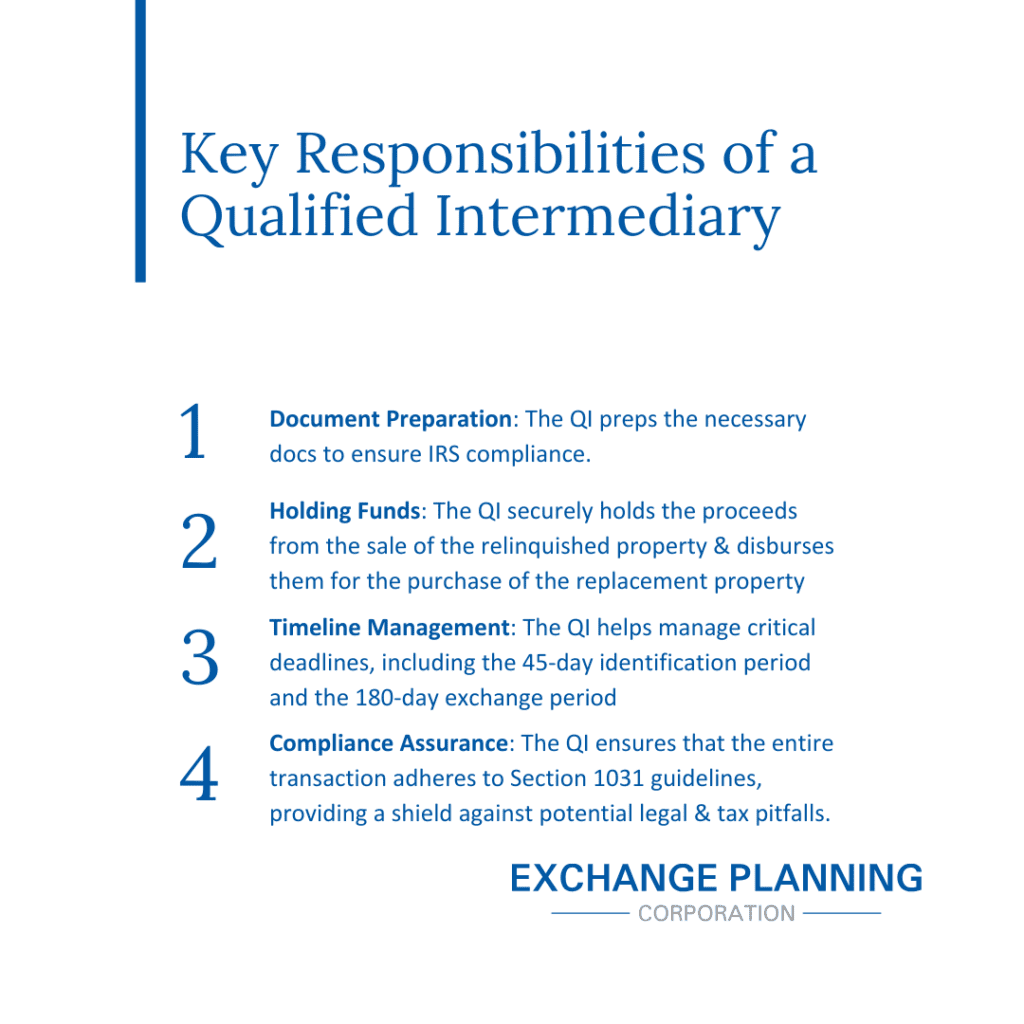

Key Responsibilities of a Qualified Intermediary

1. Document Preparation

The QI prepares the necessary legal documents, including the Exchange Agreement, Assignment Agreement, and Notice of Assignment, to ensure compliance with IRS rules.

2. Holding Funds

The QI securely holds the proceeds from the sale of the relinquished property and disburses them for the purchase of the replacement property, maintaining the necessary separation between buyer and seller.

3. Timeline Management

The QI helps manage critical deadlines, including the 45-day identification period and the 180-day exchange period, ensuring the process stays on track.

4. Compliance Assurance

The QI ensures that the entire transaction adheres to Section 1031 guidelines, providing a shield against potential legal and tax pitfalls.

Choosing the Right Qualified Intermediary

Selecting a trustworthy and experienced QI is crucial for a successful 1031 exchange. Here are some factors to consider:

- Experience and Expertise: Look for a QI with a strong track record in handling 1031 exchanges and relevant industry certifications.

- Insurance and Bonding: Verify that the QI has adequate insurance coverage and bonding to protect the funds.

- Transparency and Communication: A good QI maintains clear and regular communication, providing updates and answering questions throughout the process.

Conclusion

The Qualified Intermediary is more than just a facilitator in a 1031 exchange; they are a safeguard, a guide, and a critical part of the process that ensures compliance, efficiency, and peace of mind. By understanding the role and choosing the right QI, investors can optimize the benefits of a 1031 exchange and navigate the complex landscape with confidence.

FAQ

Q: What qualifications should a Qualified Intermediary have?

A: They should have experience in handling 1031 exchanges, necessary certifications, and proper insurance coverage.

Q: Can I handle a 1031 exchange without a Qualified Intermediary?

A: No, a QI is required by the IRS to facilitate the exchange process, hold funds, and ensure compliance.

Q: How do I find a reputable Qualified Intermediary?

A: Research online, ask for referrals from real estate professionals, and check their track record, experience, and credentials.

Q: What are the risks of choosing the wrong Qualified Intermediary?

A: Risks include potential non-compliance with IRS rules, mishandling of funds, and failure to meet critical timelines.

Q: Can a friend or family member act as my Qualified Intermediary?

A: No, the IRS has strict rules regarding who can act as a QI, and they must be a neutral third party with no close relationship to the exchanger.