Real estate agents looking for more listings in a competitive market should consider a powerful but overlooked strategy: the 1031 exchange. By helping long-term property owners understand how a 1031 exchange—especially when paired with a Delaware Statutory Trust (DST)—can save them significant taxes, you become more than an agent. You become a problem-solver.

This approach unlocks major tax advantages for the right clients and positions you as the go-to real estate professional in your market.

Why 1031 Exchanges Are the “Secret Sauce” for Getting Listings

Most agents know that a 1031 exchange allows investors to defer capital gains taxes when selling investment property. But here’s what is missed: the real value isn’t just avoiding taxes on the sale—it’s creating new tax savings on future income.

Here’s how it works:

Many property owners have held their rental real estate for 15, 20, or even 30 years. Over time, their depreciation deductions shrink while rental income increases. The result? They’re paying taxes on a bigger chunk of income with fewer write-offs.

A well planned 1031 exchange resets the depreciation schedule. That means years of fresh tax sheltering and higher after-tax cash flow—a compelling reason for a long-term owner to finally sell.

The Ideal Client Profile for This Strategy

This 1031 exchange listing strategy works best for:

- Long-term owners (15+ years of ownership)

- Low or no debt on the property

- Owners nearing retirement or seeking passive income

- Frustrated landlords tired of management headaches or poor cash flow

These clients aren’t always motivated by sales price. But show them how they can save hundreds of thousands in taxes? You’ll have their attention—and their listing.

The Power of DSTs: Debt Without the Risk

One of the biggest barriers for older investors doing a 1031 exchange is taking on new debt. This is where Delaware Statutory Trusts shine.

What Is a DST?

A DST allows your client to invest in institutional-quality real estate with non-recourse financing. That means they get the tax benefits of leverage without personal liability. The lender never even knows the investor’s identity.

Why DSTs Appeal to Older Clients

- No new personal debt

- No landlord responsibilities

- Professional management handles tenants, maintenance, and operations

- Passive income with tax efficiency

For clients who want to exit property ownership but keep their money working tax-efficiently, a DST is often the perfect solution.

What’s in It for the Real Estate Agent?

Let’s address the elephant in the room: financial advisors can’t share commissions. So why bother?

Because this strategy gets you something more valuable than a referral fee—more listings.

Benefits of Partnering with 1031 and DST Experts

- Unlock hidden listings from long-term owners who weren’t planning to sell

- Stand out from competitors with a unique value proposition

- Build partnershipswith professionals who are actively marketing to your ideal clients

- Close deals faster when sellers see how a DST exchange meets their income, tax, and retirement goals

When you help clients understand they could save 15% of their equity in long-term tax savings, you’re no longer just selling a property. You’re solving a financial problem.

How to Start the Conversation

You don’t need to be a tax expert. Just ask one simple question:

“Would you be interested in learning how to save taxes on the income from your rental properties?”

When they say yes—and they usually will—offer them a complimentary tax consultation with us.

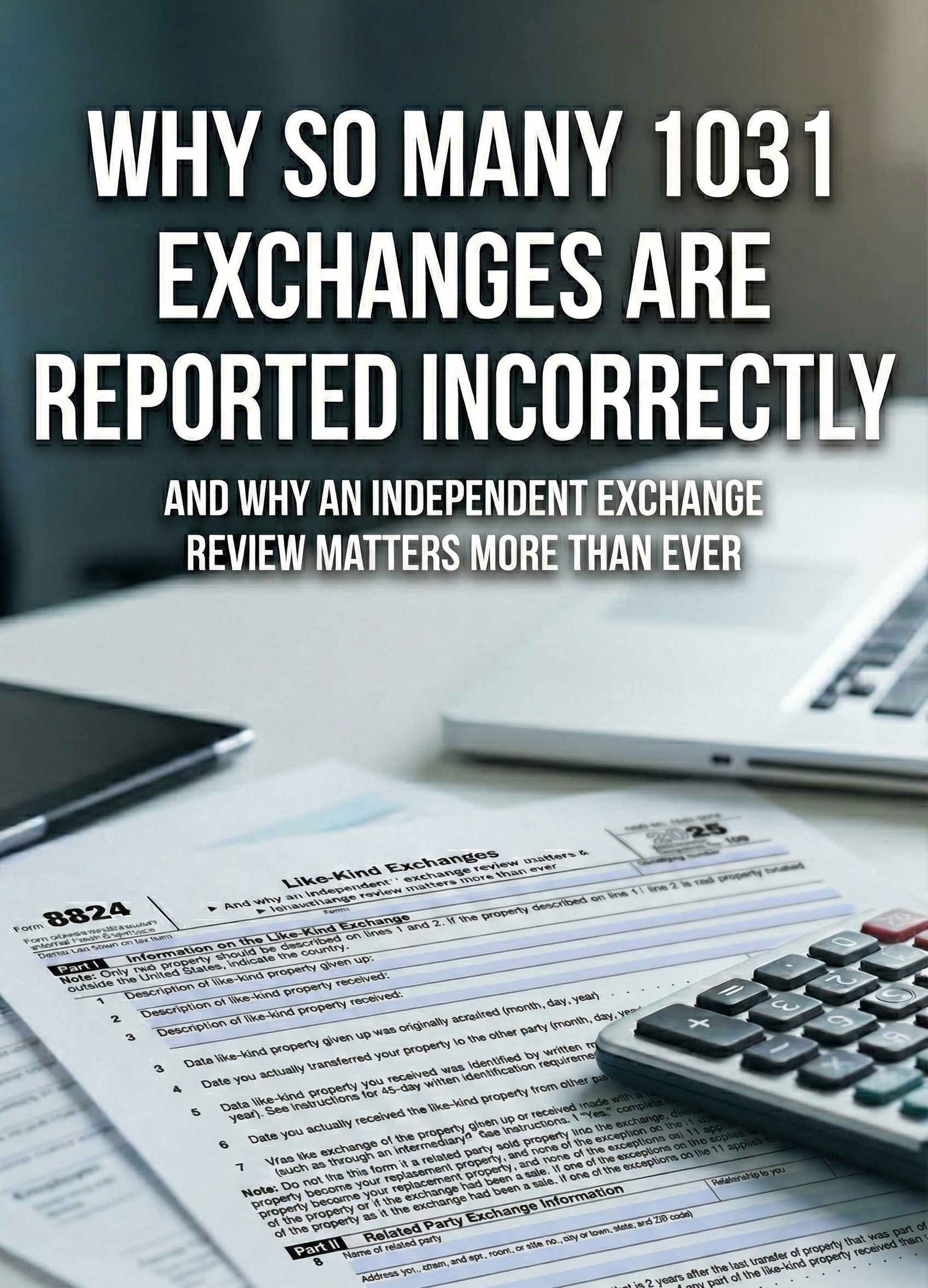

What Happens in the Free Consultation?

We’ll walk your client through:

- How much tax they could save from a 1031 exchange

- Strategies to make everyday expenses (like dinners) tax-deductible

- Whether a DST fits their retirement and income goals

If tax savings matter to your client, they’ll want to know about selling and exchanging. A 1031 exchange is one of the most powerful tax-saving tools available to real estate investors.

Why This Strategy Works

| Client Need | How 1031 + DST Helps |

| Tax Savings | Resets depreciation, shelters future income |

| Liquidity & Cash Flow | Access equity while increasing after-tax income |

| Retirement Planning | Passive income without landlord duties |

| Family Planning | Easier to pass on than physical property |

Final Thoughts: Stand Out and Serve Your Clients

Most agents ask clients if they want to sell.

You’ll be asking if they want to save taxes and increase income—a much more compelling offer.

With the support of a 1031 exchange specialist and DST provider, you’ll have the tools to help clients make the right decision for their financial future—and list their property with you in the process.

There are millions of long-term real estate owners in the U.S. who will need to sell and exchange in the next decade.

You can be the agent who shows them how.

Frequently Asked Questions

Can I earn a referral fee from a financial advisor or DST sponsor?

No. Financial advisors cannot legally split commissions. However, you gain listings and build long-term client loyalty—which is often more valuable.

Are DSTs suitable for all investors?

Not always. DSTs work best for older clients who want passive income and tax efficiency without management burdens. They’re not ideal for investors seeking hands-on control.

How do I introduce a client to Exchange Planning Corporation?

Just send an introductory email. We’ll handle the rest, including a complimentary consultation and custom tax analysis.

How much can a client save using this strategy?

A common rule of thumb is 15% of their equity in future tax savings, depending on property type and depreciation history.

Do I need to be a tax expert to use this approach?

Not at all. You just need to open the conversation. We handle everything else.